In the complex landscape of Forex trading, selecting the right broker is a pivotal decision that can significantly influence a trader's success.

Critical factors such as regulatory compliance, the functionality of trading platforms, and the structure of fees all play essential roles in this process. Understanding these elements not only enhances trading efficiency but also safeguards investments.

As we explore the nuances of broker selection, it becomes clear that a comprehensive approach is necessary to uncover the most suitable options available. What specific criteria should traders prioritize to ensure they make an informed choice?

Understanding regulatory compliance is crucial for any trader seeking a reliable forex broker, as it ensures that the broker adheres to the legal standards and practices set forth by financial authorities.

Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US, impose strict guidelines to protect investors from fraud and malpractice. A compliant broker is required to maintain transparency in operations, segregate client funds, and provide accurate reporting.

Moreover, engaging with a regulated broker enhances traders' confidence, as it signifies a commitment to ethical conduct and consumer protection. Therefore, verifying a broker's regulatory status should be a priority for traders to mitigate risks and ensure a secure trading environment.

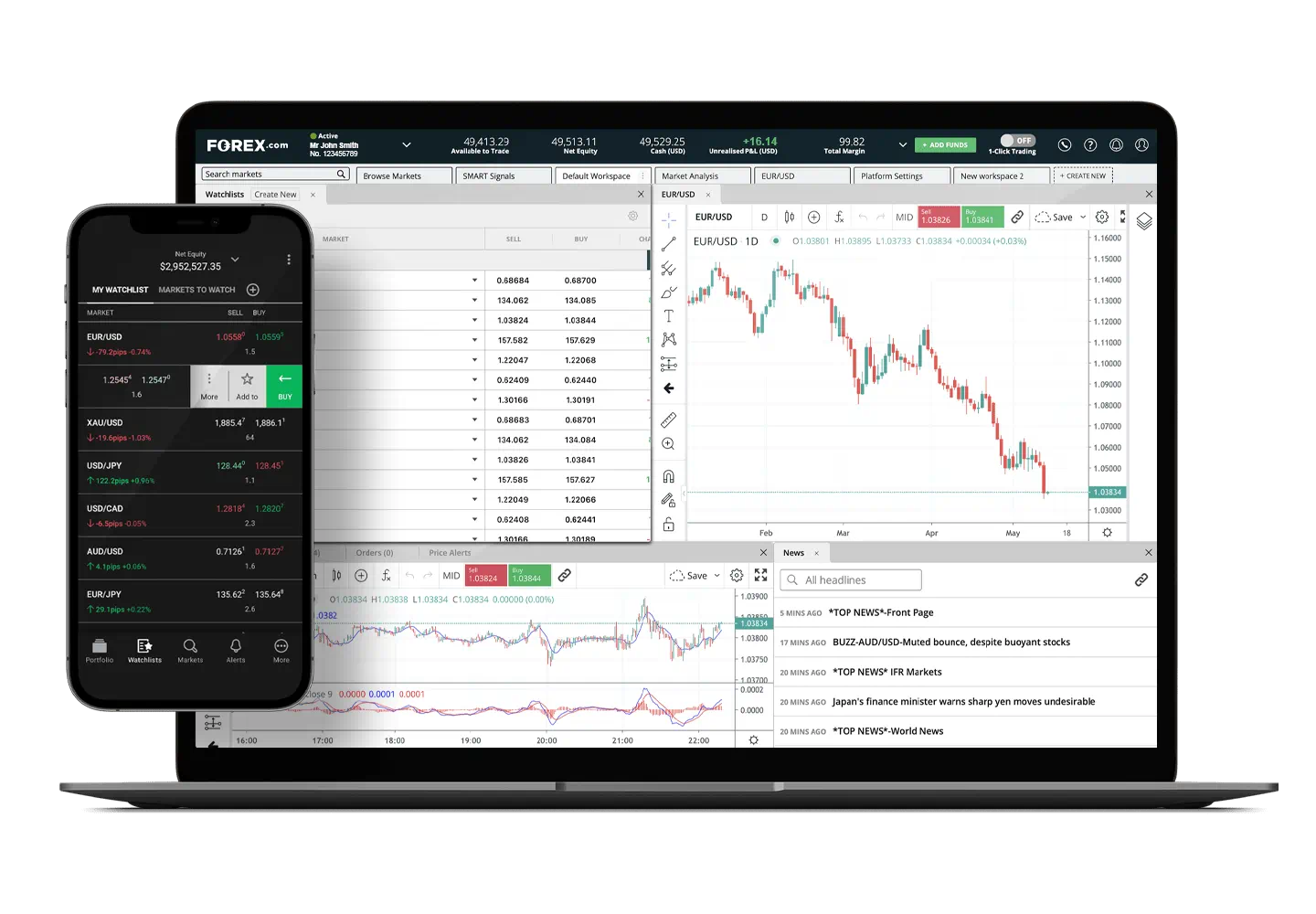

When selecting a forex broker, the evaluation of trading platforms is paramount, as the platform serves as the primary interface for executing trades and managing accounts. A robust trading platform should offer a user-friendly interface, allowing traders to navigate seamlessly through various features.

Key functionalities to consider include advanced charting tools, technical indicators, and real-time data feeds, which are essential for informed decision-making. Additionally, the platform's compatibility with different devices, such as desktops, tablets, and smartphones, ensures flexibility for traders on the go.

Furthermore, examine the platform's execution speed and reliability, as these factors directly impact trading performance. Overall, a well-designed trading platform can significantly enhance a trader's experience and success in the forex market.

One of the critical aspects to consider in forex trading is the analysis of fees and spreads. Fees may encompass commissions, overnight financing charges, and withdrawal fees, which can significantly impact trading profitability.

Understanding these costs allows traders to accurately gauge their potential returns. Spreads, the difference between the bid and ask price, are another vital consideration; they reflect the broker's cost of executing trades. Tight spreads are generally favorable, as they minimize transaction costs.

It is essential to compare the fee structures and spreads of various brokers to determine which offers the most competitive conditions. Ultimately, a thorough evaluation of these factors can lead to more informed trading decisions and better overall performance in the forex market.

Evaluating customer support is essential for traders seeking a reliable forex broker. Effective customer support can significantly enhance the trading experience, particularly during critical trading hours or when issues arise.

Traders should assess the availability of support channels, such as live chat, email, and phone assistance, ensuring they are accessible 24/5 or 24/7. Response times and the effectiveness of solutions provided are also crucial; quick and knowledgeable responses can prevent minor issues from escalating. Additionally, brokers that offer multilingual support may cater to a diverse clientele, further enhancing service quality.

Reading customer reviews about support experiences can provide valuable insights into the broker's reliability and commitment to client satisfaction. Ultimately, strong customer support can be a decisive factor in a trader's choice of broker.

Selecting the right account type is crucial for traders, as it directly impacts their trading experience and potential profitability. Forex brokers typically offer various account types, including standard, mini, and micro accounts, each catering to different trading styles and capital requirements.

Standard accounts generally require a higher minimum deposit but offer access to more significant leverage and lower spreads. In contrast, mini and micro accounts allow traders to start with smaller investments, making them ideal for beginners or those looking to manage risk.

Additionally, some brokers provide specialized accounts, such as ECN or STP accounts, which facilitate direct market access and enhanced transparency. Evaluating these options carefully allows traders to align their account choice with their financial goals and trading strategies.

Access to quality educational resources can significantly enhance a trader's ability to navigate the complexities of the Forex market. When selecting a broker, it is crucial to evaluate the educational offerings they provide. Comprehensive resources can equip traders with essential knowledge and skills.

Additionally, interactive tools, like simulators and demo accounts, allow traders to practice strategies without financial risk. A broker that prioritizes education demonstrates a commitment to client success, fostering a more informed trading environment.

Furthermore, continuous learning opportunities can help traders stay updated on market trends and strategies, ultimately leading to better decision-making and improved trading performance. Therefore, consider the educational resources available when choosing a Forex broker.

The duration for withdrawing funds from a trading account can vary significantly based on several factors, including the broker's policies, the withdrawal method chosen, and regulatory requirements. Typically, electronic withdrawals may take 1 to 3 business days, while bank transfers could take longer, often up to a week. It is advisable to review specific withdrawal terms provided by the broker to set realistic expectations and ensure a smooth transaction process.

Brokers typically offer a range of leverage options to accommodate varying trading strategies and risk appetites. Commonly, leverage ratios can range from 1:10 to 1:500, with some brokers providing even higher ratios. However, it is essential for traders to understand the implications of using high leverage, as it can amplify both potential profits and losses. Regulatory frameworks in different regions may also influence the maximum leverage available to traders.

When selecting a forex broker, it is crucial to be aware of potential hidden fees that may affect your trading costs. These can include spreads, commissions, overnight financing fees, and withdrawal charges. Additionally, brokers may impose inactivity fees if your account remains dormant for an extended period. Thoroughly reviewing the broker's fee structure and terms of service is essential to ensure transparency and avoid unexpected costs that could impact your profitability.